Give Me ONE Day And I'll Show You...

The Business Creditline Approval Blueprint:

5 Steps to $100K - $250K in 120 Days

Get Hundreds of thousands in Prime +1%, Unsecured, No-Doc, Top-Tier Bank

Business credit Lines and Loans in the next 120+ Days...

Learn the new FICO® validated bank lending strategies to maximize small business funding approvals.

Learn how to implement our proven process that helps a whopping 93% get approved on their first try for

top-tier bank credit lines, loans, and financing.

JOIN US LIVE ON ZOOM...

Business Funding Approval Bootcamp

September 6, 2025

Secure Your Spot Today -

ONLY 50 SEATS AVAILABLE!

JOIN US LIVE ON ZOOM...

5-Step Business Funding Approval Bootcamp

September 6th, 2025

Secure Your Spot Today - ONLY 50 SEATS AVAILABLE!

Get Fundable! presents

5-Step Business Funding Approvals Bootcamp

Saturday, September 6th 9am - 5pm Mountain

Learn how simple and easy it is to get top-tier bank approvals using the the system developed in collaboration with FICO® team members over the last 8-years by Merrill Chandler:

• Best-Selling Author of "The New F* Word"

• Personal and Business Funding Approval Wizard

• Co-Founder of Lexington Credit Repair Law Firm

• Mad Scientist behind the 5-Step Business Funding Approvals Path™

Finally GET APPROVED! for the top-tier bank credit lines and loans that will grow your business AND secure your future!

Saturday, September 6th 9am - 5pm Mountain

ONLY 50 SEATS AVAILABLE

Your Bootcamp Full-Day Event Pass Includes:

MORNING SESSION

"From Declined to Approved:

Borrower Profile Optimization Strategies"

+ Software

($1494 Value)

The first two steps of the 5-Step Funding Approvals Path™ deal with the quality and approval-readiness of your Personal Borrower Profile. The MORNING SESSION of the Bootcamp will do a deep-dive into how to:

PROTECT YOURSELF FROM HIDDEN PERSONAL CREDIT LANDMINES

The personal credit system is full of misinformation and manipulative operators. In this session, you will discover:

Misleading techniques that promise to "build your personal credit" but actually harm your borrowing capacity...

Why "debt consolidation services" are a harmful scam (RUN!!)...

Why filing for bankruptcy isn't the reset button you think it is...

The risks that “credit card stacking” has to your future business funding opportunities.

LEVERAGE BANKS APPROVAL PROCESS

In this session, you will learn EXACTLY how the credit approval process works and how you can get game-changing approvals on your applications. You will discover:

What a "Denial Threshold" is and at which banks you have a chance of getting approved...

How bank approval software ACTUALLY uses your credit score and how to improve your approval chances...

How your FICO® Score determines your approval amounts.

STEP 1 - MINIMIZE NEGATIVE IDENTITY AND ACCOUNT DATA TO MEET BANK TIMETABLES

FICO® and banks have secret "aging" timetables that evaluate your borrower identity and derogatory accounts, In this session, you will learn how to use our Personal Borrower Profile Optimization System™ software*** to:

Synchronize and cure your borrower "identity crisis" that is pushing your applications into "manual review"...

Audit your negative accounts to know when you pass bank approval timetables and can apply successfully for credit...

Implement the Advanced Audit and Dispute Templates to leverage your borrower identity to remove, inaccurate, erroneous, and unverifiable derogatory accounts and track your results with your Personal Borrower Profile Optimization System™ software***

STEP 2 - ALIGN YOUR "BORROWER BEHAVIORS" TO ALIGN WITH BANK APPROVAL GUIDELINES

One of the most well-kept insider banking secrets is that there are 150 FICO® Borrower Behaviors that each bank chooses from to use in their approval software to evaluate whether or not to lend to you. In this session, you will learn how to:

Identify bank "traps" that reveal your "consumer" Borrower Behaviors that cause you to be denied...

Evaluate your profile and close destructive low-value accounts without harming your profile...

Assess and optimize the timing of your inquiries to maximize approvals...

Use our Personal Borrower Profile Optimization System™ software*** to optimize your credit card balances to attract credit limit increases and new credit approvals (software included with Bootcamp registration)...

Leverage to your benefit how banks use Borrower Behaviors instead of your credit score to approve you...

***Software is included in Bootcamp registration

The first two steps of the 5-Step Business Funding Approvals Path™ deal with the quality and approval-readiness of your Personal Borrower Profile. The MORNING SESSION of the Bootcamp will do a deep-dive into how to:

STEP 1: Minimize Negative Borrower Profile Data

Banks and FICO® use hidden “aging” timelines to evaluate your identity and negative accounts. Our Personal Borrower Profile Optimization System™ software helps you:

Fix your borrower identity so apps stop going into “manual review” black holes...

Know exactly when negative items no longer hold you back...

Use powerful dispute tools to eliminate inaccurate, outdated, and unverifiable versions of your identity and negative listings—and track results in real-time

STEP 2: Align Your Borrower Behaviors with Bank Approval Guidelines

Forget what you think you know—your financial behavior matters more than your score. FICO® tracks over 150 Borrower Behaviors, and banks pick the ones they care about most. You’ll learn how to:

Spot your “consumer” behaviors that scream “DENY ME!” to banks...

Close low-value accounts without damaging your profile

Time your inquiries for maximum approval power...

Adjust your card balances the right way to trigger limit increases and new offers...

Leverage your borrower behaviors—not just your score—to win bank trust and funding approvals

SESSION BONUS: Protect Your Personal Credit from Deceptive Marketers

As a business owner, bad credit advice doesn’t just hurt you—it can cripple your ability to grow and get funding. In this no-BS session, you’ll discover:

The “credit-building” myths that sabotage your personal credit—and keep real lenders saying NO!

Why “debt consolidation services” are a trap, not a solution—and how it destroys your future approval opportunities...

The harsh secret behind bankruptcy—it’s not the reset button you think it is...

How credit card stacking can kill your shot at serious business funding—before you ever walk into a bank

SESSION BONUS: Unlock the Bank’s Approval Code: Get the YES! You Deserve

Tired of mystery rejections and low-limit approvals? This session rips the cover off how banks really decide who gets funded—and how you can stack the odds in your favor. You’ll discover:

What a "Denial Threshold" is—and how to use it to get more approvals...

How approval algorithms actually use your credit score (hint: it's NOT what you've been told)...

How your FICO® Score affects your approvals—and how to get more and higher amounts

AFTERNOON SESSION

Bank-Grade Approvals:

The Fast-Track to $100K–$250K in Business Creditlines

+ Software

($1494 Value)

The final three steps of the 5-Step Business Funding Approvals Path™ deal with the quality and bank-readiness of your Business Borrower Profile. The AFTERNOON SESSION of the Bootcamp will do a deep-dive into how to:

Step 3: Make Your Business Approval-Ready

Want $100K+ credit lines and real bank loans? Then your business identity and data better check all the right boxes. In this session, you’ll:

Learn what banks look for in a truly fundable business...

Use the right business model to avoid being flagged as “high-risk” or a “restricted business”...

Spot and fix funding-killer words, codes, and data on your business profile...

Get your business listed correctly in all 21 key verification databases banks check before they say “YES!”...

Protect your business identity and credibility with our proven reputation system

Step 4: Build Profitable Banking Partnerships with Viable Banks

Banks will either see you as a partner or "prey." Make sure it’s the first. In this session, you’ll learn:

7 banker questions that reveal whether a bank is worth your time—or a dead end...

How to use our Bank Vetting & Evaluation Software™ to find real funding banks with high-limit credit line and loan options...

The exact way to open accounts that pass all internal bank “should we lend to this borrower" tests...

How to trigger “high-value client” status—and massively increase your approval chances

Step 5: Unlock Approvals Using FICO® Smart Banking & Application Strategies

Banks don’t just look at your credit—they watch how you use your money. Want top-tier approvals? In this session, you’ll discover:

How your account balances affect your funding limits—and when to apply to get the biggest “YES!”

Why your deposit habits build the bank’s trust—or break it...

How to activate the bank’s “relationship matrix” to unlock pre-approved offers...

The key application strategies that maximize what you include—while avoiding the hidden traps buried inside every business credit application...

Why our Funding Hackers see a 93% approval rate on their first try—for prime + 1%, unsecured, stated-income business credit lines

SESSION BONUS: Spot the Liars: Identify Business Credit Imposters

The business credit world is full of bad advice and bait-and-switch tactics. In this session, you'll uncover:

Which so-called “business” credit cards secretly wreck your personal credit and funding chances...

How credit card stackers use slick language to trap business owners in destructive, high-risk debt...

Why “business credit builders” often sell vendor junk—not real bank funding—and how to spot the lie

***Full access to our proprietary software is included with your Bootcamp registration—because strategy without tools is just theory.

The final three steps of the 5-Step Funding Approvals Path™ deal with the quality and bank-readiness of your Business Borrower Profile. The AFTERNOON SESSION of the Bootcamp will do a deep-dive into how to:

IDENTIFY DECEPTIVE BUSINESS CREDIT PRACTICES: The business credit universe is full of misinformation and manipulative operators. In this session, you will discover:

Which lenders offer imposter "business" credit cards which actually report to and ruin your personal profile and future business approvals...

How most credit card "stackers" use manipulative language to deceive unsuspecting business owners into destructive credit scams...

How "business credit builders" use deceptive language to make you believe you are getting bank credit lines, instead of worthless vendor and retail accounts

STEP 3. OPTIMIZE YOUR BUSINESS IDENTITY AND DATA TO BE BANK VERIFICATION-READY

One of the best kept business funding secrets is what banks are looking for to approve you for multiple $100K credit lines and loans. In this session, you will:

Learn the characteristics of a highly fundable business...

Discover the most fundable business model that separates YOU from WHAT YOU DO so you don’t trigger “restricted industry” landmines…

Determine if YOUR business has any "funding killer" terms, business codes, or negative indicators...

Identify the 21 Business Verification Databases that must uniformly report your business identity and data to get approved...

Learn the best reputation management system to ensure business identity integrity

STEP 4. ESTABLISH PROFITABLE BANKING PARTNERSHIPS WITH VIABLE BANKS

Not all banks will lend to you. And if you find one that will, you will be evaluated as either "prey" or a "partner" based on your Borrower Behaviors. In this session, you will learn:

7 questions to ask a banker to determine if their bank is worth exploring further...

How to use our Bank Vetting and Evaluation System™ software to find a "qualified funding bank" that has high-value credit lines...

How to open your business account at your qualified funding bank and pass the banks "tests" that would label you as un-fundable…

To positively trigger “high-value client” metrics and ensures credit line approvals when you apply

STEP 5. UNLOCK APPROVALS USING BANK BALANCE, DEPOSIT, AND APPLICATION STRATEGIES

Before you apply for top-tier bank credit lines and loans, you must trigger the bank software to notice you as a viable credit line/loan approval candidate. In this session, you will learn:

Why your balances matter to banks and how to positively influence the timing of your credit line and loan approvals...

How your monthly deposits behavior create a trust-worthy track record...

How banks use a "relationship matrix" to determine when bank personnel should offer you a pre-approved credit line…

Important application secrets that allow you to MAXIMIZE what you include in your applications...

How to avoid the lender tests and landmines disguised in every credit application

Why our Funding Hacker community members have achieved 93% first-time application approval success for prime + 1%, unsecured, stated-income top-tier bank business credit lines and loans

***BONUS: Software is included in Bootcamp registration

Total Software and Course Value: $2998

Who Is This Bootcamp For?

Are you looking to close more deals…FASTER…EASIER…and CHEAPER?

Do you want the simplicity of writing a business credit line check to do a deal?

Tired of hard money and private lenders looking over your shoulder to monitor how you spend every dime?

Do you want to stop waiting on appraisals, paperwork, asset assessments, or deal approvals?

Are you ready to grow your real estate portfolio the way you have always wanted?

Are you looking to build legacy wealth?

Do you KNOW you can do more in your business if you could only access better financing and funding?

Do you want to be in charge of your destiny?

Are ready to save thousands on your current investments, just by accessing lowest-cost money and bigger bank credit lines?

If you answered YES to any of these questions….

Then this Bootcamp is for you!

WHAT WOULD IT MEAN FOR YOU TO get approved for THE BEST BUSINESS FINANCING AND FUNDING possible—The kind That real estate and business Entrepreneurs Find Impossible get?

You know the ones...those versatile Prime + 1%, Unsecured, Stated-Income, No-Doc

Top-Tier Bank Business Credit Lines and Loans?

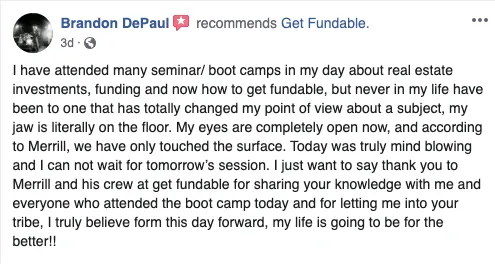

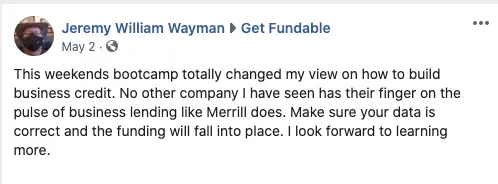

Here’s an example of what our Bootcamp attendees have achieved – are you next?

Secure Your Event Pass Today:

ONLY 50 SEATS AVAILABLE

Who Is This Bootcamp For?

Are you looking to close more deals…FASTER…EASIER…and for LESS COST?

Do you want to be able to write a check to do a deal?

Do you want to stop waiting on appraisals, paperwork, asset assessments, or deal approvals?

Are you ready to grow your real estate portfolio the way you have always wanted?

Are you looking to build generational wealth?

Do you KNOW you can do more in your business if you could only access better funding?

Do you want to be in charge of your destiny?

Are ready to save thousands on your current investments, just by accessing lower-cost money and bigger bank credit lines?

If you answered YES to any of these questions….

Then this Summit is for you!

Learn How to Optimize THEN Leverage Your Personal and Business Profiles and Get Predicable Access to MORE, EASIER, and FASTER funding approvals. Every time.

This Bootcamp will teach you how our FICO® validated process will optimize your business borrower profile. You’ll walk away with the industry insider secrets to getting approved for top-tier, low-interest money every time you need it.

Most real estate investors don't think they can access these kind of bank business credit lines and loans... but with our method, it's not only possible — it's FAST and EASY!

For less than the cost of taking your family to dinner, you’ll discover…

How to get the cheapest money available to do your deals...

As a real estate investor or business entrepreneur, you’re not doomed to relying on EXPENSIVE hard or private money. By leveraging your business borrower profile the right way, you can access inexpensive bank money NOT usually available to real estate investors and small business owners.

Why 99% of real investors can’t get lowest-cost money...

Avoid the hidden bank traps that label you as a "consumer" and access the bank credit lines and loans that will make growing your real estate or business easier and less expensive within 120+ days.

The #1 secret to saying goodbye to expensive hard money...

Get Approval-Ready™ for top-tier funding using our tested and proven 5-Step Business Funding Approvals Path™.

How to turn decades into days by avoiding the 3 biggest mistakes that kill your financing and funding approvals...

We have learned where all the funding approval landmines are hidden so that you can avoid them and get a YES! from banks. Say goodbye to financing and funding confusion, worry, and stress.

The 5 funding factors you need to unlock near limitless business credit, financing, and funding approvals.

Pay attention – these 5 elements can make the difference between “DENIED” and DONE DEAL!

Discover the Key To

Business Financing & Funding Approvals

And Start Accessing Better, Faster, Easier, and Cheaper Money For Your Real Estate and Business Dreams

A Personal Note from Bootcamp Host:

Merrill Chandler

– Best-Selling Author of "The New F* Word"

– Personal and Business Funding Approval Wizard

– Co-Founder of Lexington Credit Repair Law Firm

– Mad Scientist behind the 5-Step Business Funding Approvals Path™

A Personal Note from Summit Host:

Merrill Chandler

Best-Selling Author of “The New F* Word”, Peak-Performance Fundability Coach, Co-Founder of Lexington Law Firm

Hi there!

What's holding you back from taking your real estate investments or business to the next level and being in control over your time and destiny?

If you’re like most people, maybe it's the idea that you don't have enough money saved, or the cost is too high, or you don't know if your credit will get you the approval you need for the HIGHEST APPROVAL AMOUNTS and the LOWEST INTEREST RATES...

Maybe you think it's NOT possible to qualify for the kind of funds you need to build the business that would really change the quality of you and your family's life.

If so, you’re in the right place – my Business Funding Approval Bootcamp will teach you the PROVEN yet little-known industry secrets to unlock those rare and extremely versatile prime + 1%, unsecured, stated-income, no-doc, top-tier credit lines and bank loans. This is the #1 KEY to building the kind of legacy and generational wealth to set you and your family up for the long term.

It's the kind of knowledge that changes lives!

But first, let’s talk:

What would it mean for you to be able to finally grow that kind of wealth for yourself?

Would you be able to fire your boss and retire your partner?

Finally help your spouse or partner quit their job?

Secure the future for your family, so that your children never have to worry about money?

Spend your days doing what you’re passionate about and making a positive impact?

With the right knowledge, it’s easier than ever to secure your future without needing to work endless hours, or rack up a lot of high-interest debt - It's called LEVERAGE.

Leveraging real estate investments or a business is the oldest and most stable way of growing your wealth — especially generational wealth. .

However, many people enter real estate or start a business with great enthusiasm…

Only to discover they have built themselves another 9 to 5 (or rather, 24/7) job.

Let me ask you a few questions:

Are you done working on someone else’s schedule?

Are you frustrated by the roadblocks to increasing your real estate investments and take-down those real estate deals that would help you wave goodbye to your boss – roadblocks like needing lots of cash or a stellar credit score or lots of cash flow?

Did you see doing real estate or starting a business as the light at the end of the tunnel, but feel disheartened as the tunnel keeps getting longer?

Are you looking for a reliable solution to help you seal the kinds of deals that can transform your life?

If you answered “Yes” to any of the questions above, then I want to invite you to attend my upcoming 1-day Business Funding Approval Bootcamp on August 1st that will unlock top-tier bank credit lines and loans usually withheld from real estate investors and business owners.

Those seemingly far-fetched dreams are much closer than you think!

I have spent nearly 30 years studying the TRUTH behind the business credit, financing and funding system — and I discovered how it ACTUALLY works. My methods have helped my clients and community lock in over $300 Million Dollars in lowest-cost financing and funding in just the last few years!

And yes, I regularly help those with less-than-perfect credit and pre-revenue businesses to optimize their capacity for business credit approvals as well!

I share this because you’ve probably done your due diligence and studied the conventional ways of financing or funding your real estate investments. Maybe you’ve felt that knot in your stomach as you tried to navigate the financing jungle...

And just when you thought you did everything right...

You're hit with a denial from your bank that would have put more profits in your pocket...

And you're forced down that dark alley to knock on the door of a hard or private money lender only to pay wicked high-cost points and interest rates.

Maybe you’ve been told that the kind of bank business credit lines — with ample funds and low interest — are simply out of your reach.

YOU HAVE BEEN LIED TO!

This is because the REAL process for getting approved doesn't rely on "good" credit scores.

That's right - your credit score is only ONE of the factors that banks look at... and it doesn't even come into play until AFTER the bank underwriting software has approved you.

Maybe you’ve heard that:

#1 — You need to be born wealthy to have a chance to make it in real estate.

#2 — There’s no point in applying for low-interest business loans or credit lines — you’ll automatically be rejected if you mention “real estate.”

#3 — Hard or private money (and all the fees that come with it) are the only way to start funding the big real estate deals you want.

BUT HERE"s THE TRUTH…

When you optimize and leverage your personal and business borrower profiles, you can secure the credit lines and loans that you need to grow your real estate portfolio or business – quickly and easily!

And while I don’t promise you’ll be able to drive a [insert your dream car here wink] tomorrow…

…most of my clients and community get their $100,000 credit line applications approved on their first try!

And that’s just the first of many! Approvals are addictive—you'll see for yourself!

Since my process doesn't hurt your personal borrower profile (because these credit lines and loans DON'T report to your personal credit) you can use what you'll learn in the Bootcamp to secure your next loan… and your next… and your next…

In fact, you’re probably much closer to these business credit line approvals than you think right now.

I know this first-hand.

Over 30 years ago, I confounded Lexington Credit Repair Law Firm — what is now the largest credit repair organization in the country. While I was there, I helped thousands of clients remove negative listings from their credit reports, but I discovered that removing those derogatory items DIDN'T make them "approval-ready." I wanted more for them than just getting some deletions. I wanted them to be "fundable" so they could get the lowest-cost credit, financing and funding approvals for high-value cars, homes and businesses.

I wanted to be able to transform any credit profile into a fundable one – regardless of the starting score or initial fundability.

I founded Get Fundable! to fulfill my mission to illuminate the path to Approval-Readiness for borrowers nationwide.

As my vision grew, it became apparent that I would need to create software to scale the process and be able to help as many people as possible. And for that, I needed...funding.

The problem was… I had never met anyone who got bank business credit by using common “business credit building” techniques.

Without this business loan, I would have to keep doing everything manually and only be able to help a handful of clients at a time. To add insult to injury, I was supposed to be the nation's leading expert on personal credit optimization, and I was afraid I couldn't even get a business loan.

I felt like a failure and I was totally embarrassed.

This Borrower Approval-Readiness software was SO important to my success that I had to try to get this loan. So put my best foot forward and applied to a few fintech companies… only to get denied by each.

And fintech loans were supposed to be easier to get than bank loans. Man, was I wrong! It was a massive failure, and I was so discouraged.

I got so desperate that I applied for the loan at my bank where I had done business for over 20 years. You know that feeling?

Sitting in the bank lobby…

Not knowing how to fill out the application…

Not knowing what it would take to get approved…

Feeling anxious…

Short of breath…sweaty palms…

I knew my life would be completely different if my bank would just believe in me enough to lend me this money. I KNEW I could pay it back. It felt like EVERYTHING depended on getting approved for this loan…

While I was waiting int he lobby, the loan officer walked towards me from the back of the branch, smiling. My heart skipped a beat in anticipation — then he said those horrible words…

“I’m sorry…”

My shoulders dropped. Everything I wanted for my business, clients, and borrowers nationwide had crumbled.

And one thought kept stabbing the back of my mind…

“Merrill… if YOU can’t get approved for a bank loan, how can you help anyone else?”

Then, as if by chance, something amazing happened...

I met David Smith at a FICO World — FICO's annual bank underwriting conference.

David is FICO's Small Business Lead and the premier expert of FICO's Small Business Scoring System (SBSS). He was one of the FICO experts that Will Lancing (FICO's CEO) referred me to so I could help more borrowers become fundable.

David Smith, FICO® Small Business Lead and SBSS Expert

In our discussions, David helped me understand the actual (and surprisingly simple) process that banks use to evaluate you as a borrower so they can determine whether they would lend to you. I was amazed, because if done right, you could apply for the best top-tier bank credit lines available WITHOUT needing financials, collateral or tax returns…

After learning about these factors, I TOTALLY UNDERSTOOD why I was denied.

And it was then crystal clear to me how to develop a system that would “optimize” PERSONAL and BUSINESS BORROW PROFILES to meet BANK business credit, financing and funding approval guidelines so that business banks would say YES!

To ME!

And to YOU!

I ran ALL OF IT by David who provided instructive feedback and referred me to the other FICO® team members to validate my process.

Then, I tried it on myself first, and I started testing this new business funding process on my own profiles.

I went back to fintech. To my amazement, this time, I was approved for a $50K unsecured loan using only a stated-income application.

I went back to my bank, and this time, I was approved for a $50K unsecured business credit line and $25K business credit card from the SAME application.

Will Lancing,

FICO® CEO

I kept going, and within months, I had locked in over $300,000 in top-tier bank business credit lines.

I WAS BLOWN AWAY!

I wanted to know that my approvals were not just a special case, so I shared my business funding process and results with my inner circle and invited them to implement this process. Without exception, everyone was approved for multiple bank business credit cards, loans, or lines of credit...

And some of their approvals were even higher than mine!

Since then, I've helped my clients and community secure over $300 Million in lowest-cost business credit, financing and funding...

And they've turned those approvals into real estate profits, business acquisitions, and leveraging opportunities that have all changed lives.

And now, I want to help you do the same!

Register below for my 5-Step Business Funding Approvals Bootcamp, where I’ll share this 5-Step Funding Approvals Path to help you Get Fundable! and Get Approved! for prime + 1% unsecured, stated-income, top-tier bank business credit lines and loans for yourself.

Take the Shortcut to Top-Tier Bank Business Credit Lines And Stop Hurting Your Personal Borrower Profile

I invested over a year of blood, sweat, and tears researching all the books, videos, and teachings promoted by so-called "experts" in the fields of credit repair, personal credit, business credit, credit card stacking, bankruptcy, among others.

What I found was disturbing.

I discovered over 500 myths, misrepresentations, and industry withholds that, like hidden landmines, blow up almost every business owner's opportunities to get the business credit, financing, and funding they need.

What’s amazing is I can now show YOU exactly what’s standing in your way of getting approved for top-tier BANK business credit cards, loans, and lines of credit — in as little as 100 days.

Why make business credit, financing, and funding harder than it needs to be?

Why reinvent the wheel when someone else has found a bulletproof way that works — every time?

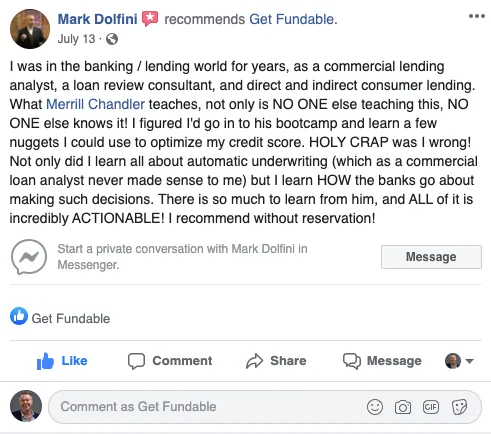

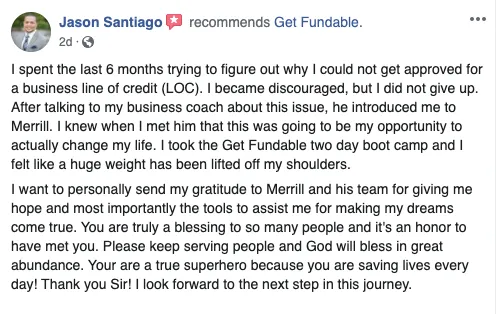

Here’s what Bootcamp attendees — just like you — have accomplished using the exact same framework you’ll learn in the Bootcamp:

Learn How to Secure Top-Tier Bank Financing and Funding for Every Deal

in my Business Funding Approval Bootcamp

With my 30+ years helping people Get Fundable! and helping them access over $300M in financing and funding, I could easily charge 5-figures for this event.

I’m not holding back anything — I promise no gatekeeping — I’ll share the secrets usually reserved for my private clients who pay $10,000+ to work with me.

But don’t worry...I’m not selling you the Get Fundable! Business Funding Approval Bootcamp for $10,000.

Even though it's worth every penny.

Not even for $5,000, $2,500, or $1,000.

Since my mission is to help as many real estate investors and small business owners as possible — remember...that’s what motivated me to create the 5-Step Funding Approval Path™ to begin with — I’m offering you a ticket to this Bootcamp for just $197.

This Bootcamp is known for turning decades-into-days. You’ll learn the advanced fundability strategies most bankers don’t even know!

I’ve been in this business for 30+ years. I co-founded Lexington Law, and then went on to launch Get Fundable! My success enabled me to become a bestselling author and an in-demand mentor to people like you who are serious about building their real-estate investing and business.

I’ve witnessed over a thousand of my clients go from despair to delight as they’re finally able to do more deals and put more profits in their pocket.

I believe the world would be better if money didn’t stop us from realizing our dreams. Nothing feels more amazing to me than seeing my clients getting the financing and funding they want for their real estate business, and enjoying the TIME AND FINANCIAL FREEDOM that awaits when they are highly profitable because they are highly fundable.

That’s why I decided not to offer this game-changing Business Funding Summit for $1000. I want it to be a no-brainer for anyone wanting to participate.

So I decided to cut that price by over 90% and offer this immersive, transformative experience for just $197.

That’s about the cost of taking your family out for a nice dinner.

If you’re done standing on the sidelines watching others succeed, and you’re serious about creating your dream life within the next year…

Join us now. I can’t wait to see you at the Bootcamp!